Investment Strategy

- Long Term Winners

- Under-appreciated Income and/or Growth

- Market Overreaction Contrarian Investments

- Opportunistic Liquidity Provision

Sometimes a single stock may fit more than one of these strategies. All long term investors want to pursue the first strategy: buying companies that are Long Term Winners. Warren Buffet follows this strategy and has done extraordinary well with it. Making good money with this strategy requires an ability to recognize how demographic and economic trends will affect an industry's revenue growth and competitive environment (i.e. profit margins), a knack for identifying companies with the management talent and business model necessary to capture a large part of the value created by those trends, and a close look at the company's current valuation to make sure the market has not overestimated its future prospects or underestimated the risks it faces.

The second strategy, finding securities with under-appreciated income and/or growth, usually involves smaller companies not well followed or understood by Wall Street. Here we are looking for companies that already generate substantial free cash flow, who have good prospects for moderate growth in cash flows, but whose stock valuation is low relative to current cash flows. For example, a company that is already generating earnings equal to 8% or more of its stock price would be a very good deal if we could be confident of 10% annual growth in such earnings. Such earnings are even more valuable if a substantial portion is paid out in dividends because in this case we don't even need the market to realize the value – the cash is going into our bank account. Fundamental valuation and qualitative risk assessment are important to finding these opportunities.

My third strategy is my favorite because it can really boost a portfolio's returns. Unfortunately these opportunities do not happen very frequently so you must use other strategies and patiently wait for an “event” to happen. What I'm talking about is big news that causes institutional players to overreact by selling off a security far below its real value. By correctly estimating the economic impact of news and accurately assessing the fundamental value of a security being sold off by the market, we can bravely buy when others are selling in panic. Such contrarian trades pay off big when the market calms down and enough investors realize that the worst case scenario has, in fact, not happened.

The fourth strategy is best explained in the context of market structure. Liquidity is the ability to buy or sell shares without significantly affecting the price with your transaction. Wall Street firms provide liquidity by standing ready to buy at their bid price or sell stocks at their ask price. On average they get paid the bid-ask difference as their compensation for this service. What I call Opportunistic Liquidity Provision is a longer term version of this market making function. What we look for is a good company that we understand the long run value of, which is relatively thinly traded. In this situation we will observe the stock price fluctuating around its true value with significant deviations in the absence of news. We can profit from this by providing liquidity to sellers at our bid price (the low end of the trading range) and liquidity to buyers by selling at our ask price: the “true” value of the stock (near the high end of the trading range within which the stock fluctuates). There is always some risk that some news will go against us while we're waiting for the buyers to show up. For this reason we use this strategy only on stocks that we are confident will pay off in the long run as well as the short term (i.e. they also fit another strategy).

Results Using These Strategies

In the interest of brevity, I will limit my discussion of specific examples but I would be happy to share more details with anyone who is interested. Over the last 15 years I can identify several major “themes” that illustrate the strategies. My first investment theme was profiting from the turmoil in emerging markets in the late '90's. I bought Russian bonds, Brazilian bonds (also 2003 election), and a Mexican cement company when the big institutional traders were selling like crazy to meet margin calls. Then, in 1999 I started buying Real Estate Investment Trusts (REITs) when they were out of favor and continued to buy under appreciated companies until the market finally recognized their value and bid them up to what I consider “true” value. Next, I bought companies that were oversold in the wake of 9/11 (mostly reinsurance). Later, I profited from the Freddie-Mac accounting scandal and the Insurance industry scandal - thanks to short-term market mis-pricing of these securities. My most recent investments in beaten down financial stocks have yet to pay off, but these have large potential gains given their underlying earnings potential.

On an absolute return basis I have done very well. My annualized rate of return over the 15 years ended 12/31/2013 was 9.3%. You may not think much of this until you realize that this period covers one of the worst periods in market history. The S&P 500 index return over this period was just 4.6%. Cumulatively this means that $100 invested 15 years ago in the S&P 500 would have grown to $196 while my $100 grew to $380.

Although my strategy uses concentrated portfolios that tend to exhibit significant short term volatility, my strategy of buying at large discounts to underlying asset value is a very low risk strategy when viewed over a time frame appropriate to revealing fundamental value. (For a detailed discussion of the relationship between risk and time horizon click HERE).

The Product: Risk Tailored Portfolios

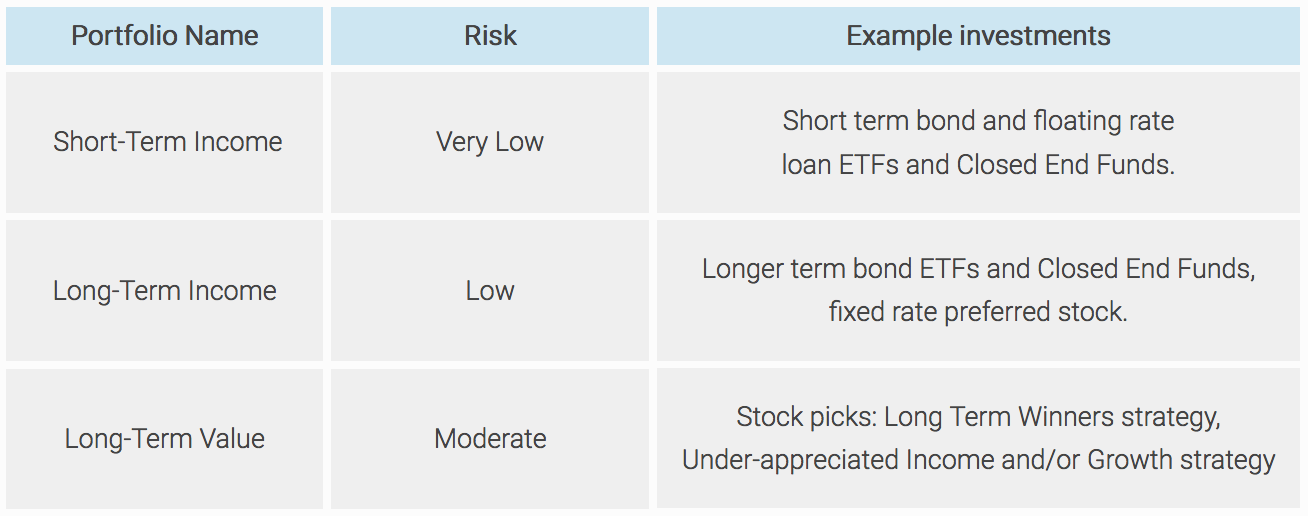

Based on each client's investing horizon, risk tolerance, and return goals we will recommend spreading their money across four tailored portfolios summarized in the following table.

See a discussion of Risk Management